Table Of Content

Many credit card companies allow you to check your credit score for free. Credit monitoring services are also an excellent option for ongoing updates. You can go directly to each credit bureau (Equifax, Experian and TransUnion) or myFICO as well, although service fees may apply.

Step 7: Pay bills on time to build a positive payment history

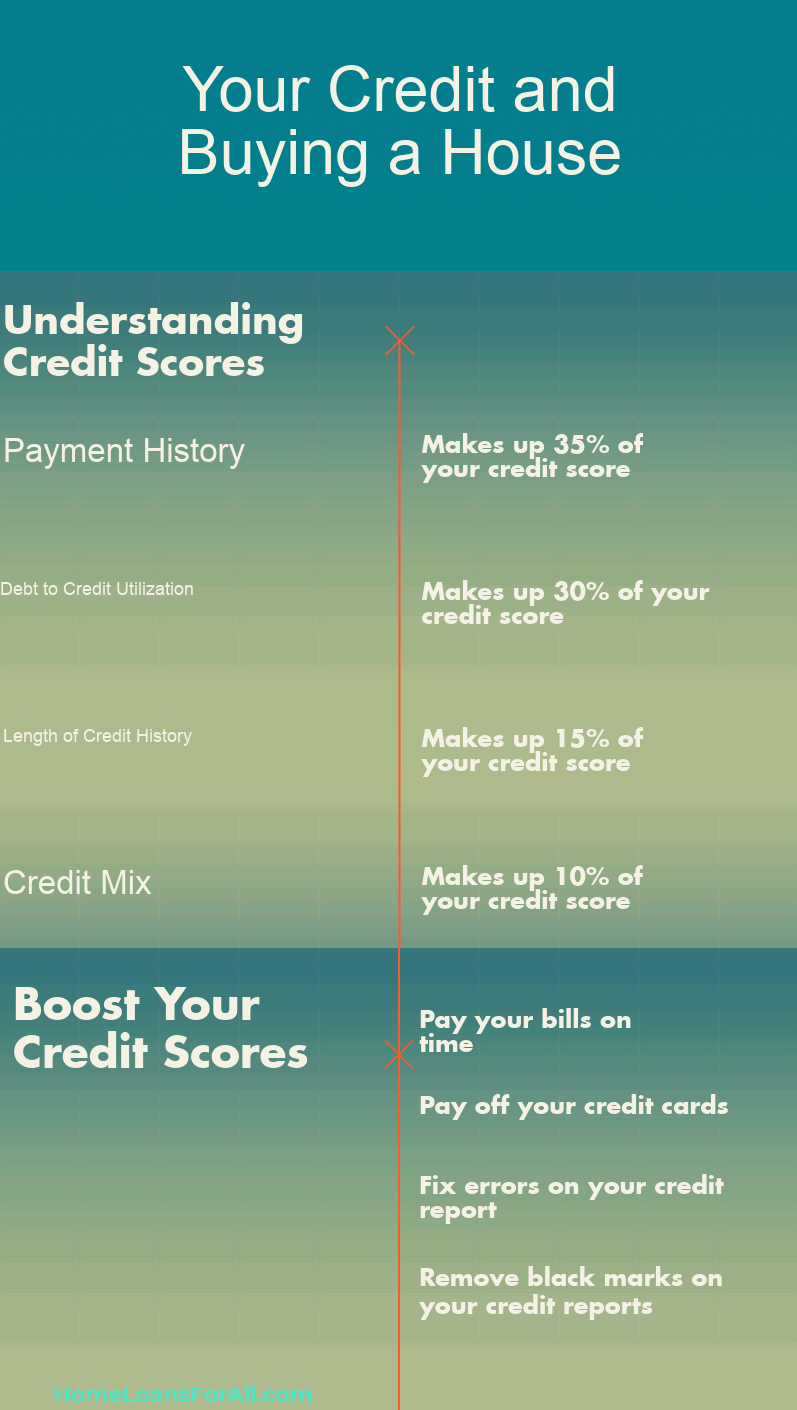

Unlike traditional credit cards, secured cards require a cash deposit that serves as your credit limit, which reduces the risk of delinquency or default. This makes it easier to get approved even with a low credit score. Though not as important as your payment history or utilization ratio, the ages of your accounts, whether open or closed, play an important role when it comes to calculating your credit score. The longer you’ve had credit, the more experience you’ve had with debt management, which is proof to the credit bureaus that you should have a higher credit score. Department of Agriculture (USDA) has similar requirements as other financial products. You need a 620 FICO score and a debt-to-income ratio that is 41% or lower.

What Lenders Look For

You can get a refinance in most cases if you have a 620 FICO score or higher, but there are some options available for people who don’t have the best credit. For example, you can improve your credit score, reduce your debt-to-income ratio, and make a larger down payment to lower your loan-to-value ratio. A bad credit score doesn’t necessarily have to hold you back from your dream of homeownership. It may be more challenging to get a mortgage, but it’s still possible. However, you’ll have fewer options and could pay more for your loan. If possible, consider postponing your home purchase until you’re able to improve your credit score.

Mortgages

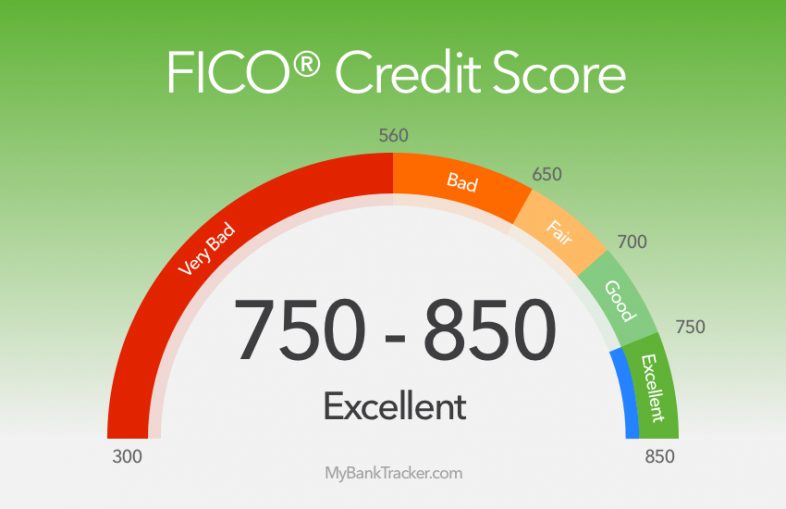

(A good credit score is 670 or higher, according to FICO.) But it’s possible to qualify with a credit score below that range, depending on the type of mortgage loan. Intended for borrowers with low-to-average income for their area, these loans provide 100% financing with reduced mortgage insurance premiums, often at below-market interest rates. The purchased home must be in a "rural" area, with lenders typically requiring a credit score from 520 to 640.

What credit score do you need to secure a mortgage? - CNBC

What credit score do you need to secure a mortgage?.

Posted: Fri, 09 Feb 2024 08:00:00 GMT [source]

Sky News Services

Be prepared to provide documentation, such as pay stubs, tax returns and bank statements. Ideally, you'll want to have a credit score of 740 or better if you're getting ready to buy a house, since this will help you get a good mortgage rate. But it's possible to buy a house with a much lower score, particularly if you get an FHA loan, which allows scores down to 580 or even 500 with a large down payment. You could pay down your credit card balances to reduce your credit utilization rate.

Should I Buy A House Now Or Wait? Is It A Good Time? - Bankrate.com

Should I Buy A House Now Or Wait? Is It A Good Time?.

Posted: Thu, 25 Apr 2024 13:41:15 GMT [source]

Specifically, mortgage lenders usually review your FICO Score 2 based on Experian data, FICO Score 5 based on Equifax data, and FICO Score 4 based on TransUnion data. A credit score is calculated based on information from your credit report. Before buying a home, you’ll likely want to check both your credit report and your credit score.

Because it's not possible to sell them to a federally insured mortgage provider, these loans are riskier for the lender. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

How mortgage lenders view credit scores

Since not all loans require the same credit score, here are a few different types of home loans and the credit score requirements for each. Below, CNBC Select outlines credit score requirements for mortgages, how to prime your credit and mortgage options if you have bad credit. Your credit score helps lenders determine your ability or inability to repay the mortgage (and, subsequently, their risk). Lenders also examine your debt-to-income ratio (DTI), the percentage of monthly debt obligations relative to how much income you bring in. You can rebuild your credit with a secured credit card or credit-building loan.

Can You Get a Mortgage With a Bad Credit Score?

In short, this is because NI cuts are more than offset by other tax rises. That comes after a government-backed code of conduct was withdrawn in June 2022, after a legal challenges by parking companies. She added people who want to get rid of the pets sometimes call zoos for help, which then call on her charity. "Status symbol" pets are being given up by owners who get scared as they grow up, an animal charity has said, with the cost of living possibly paying a part in a rise in separations. The next Bank of England decision on rates comes on 9 May - and pretty much no one is expecting a cut from the 16-year high of 5.25% at that stage. These will impact nearly two million self-employed people, according to the Treasury.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. The money story of the week has been mortgage rates - with a host of major lenders announcing hikes amid fears the Bank of England may delay interest rate cuts. With house prices at already extortionate levels, now mortgage rates rising again, is there any hope for first-time buyers?

Opting for a shorter loan term could also help you to get a lower rate. Looking for more tips on how to boost your credit before buying a house? Check out this guide on seven ways to improve your credit scores. According to the USDA, borrowers typically need a credit score of at least 640 for the direct loan and at least 680 to qualify for the guaranteed loan.

No comments:

Post a Comment